🎯 Headlines, Puns, and Market Chaos: If you thought the EUR/USD drama couldn’t get more thrilling—spoiler alert—it did. From textbook technical patterns to a crash that even bears applauded, this pair has been a rollercoaster. Let’s dive into the juicy details and plot the next moves.

The Setup: When Charts Speak Louder Than Politicians 🗺️📉

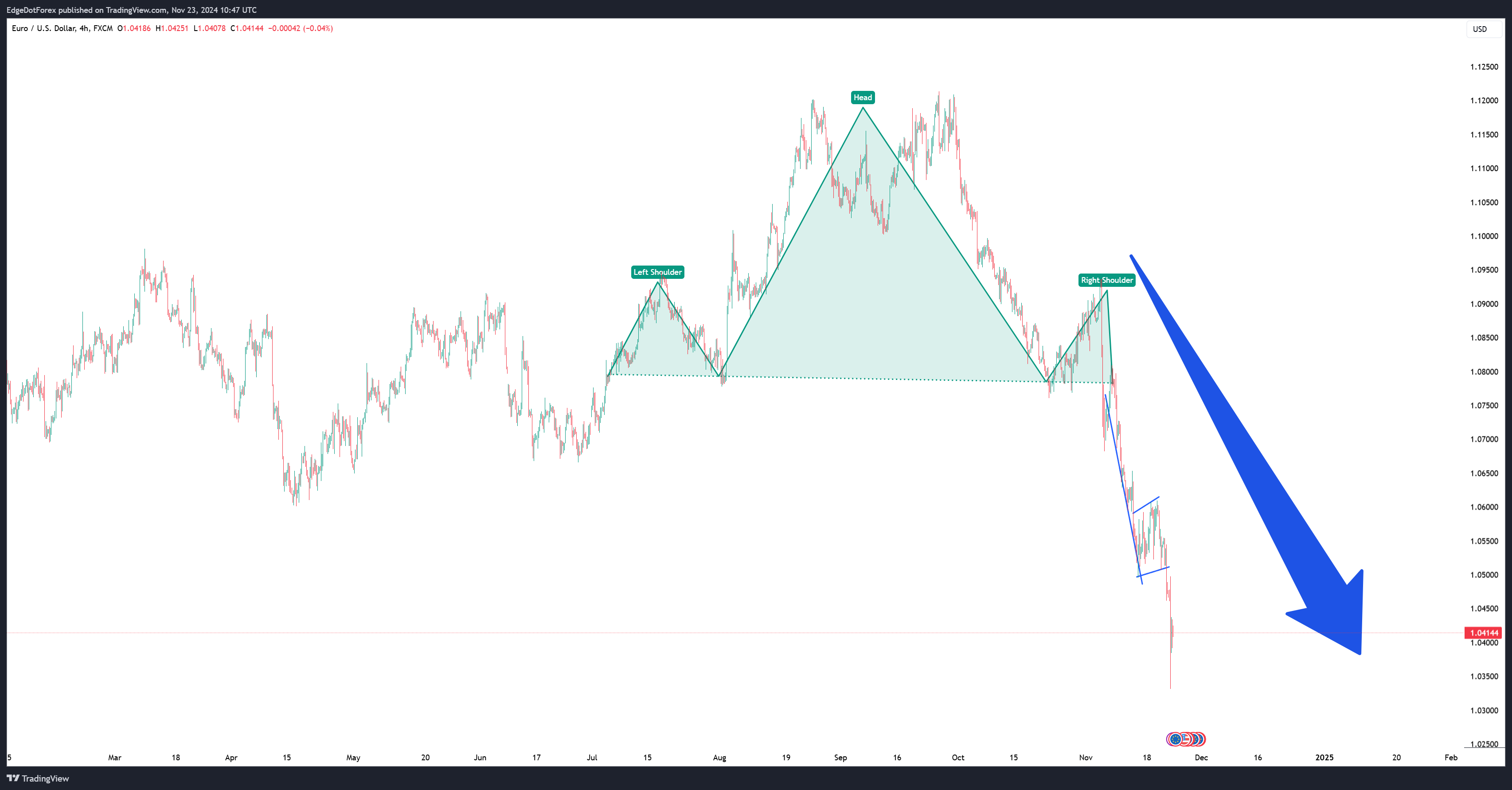

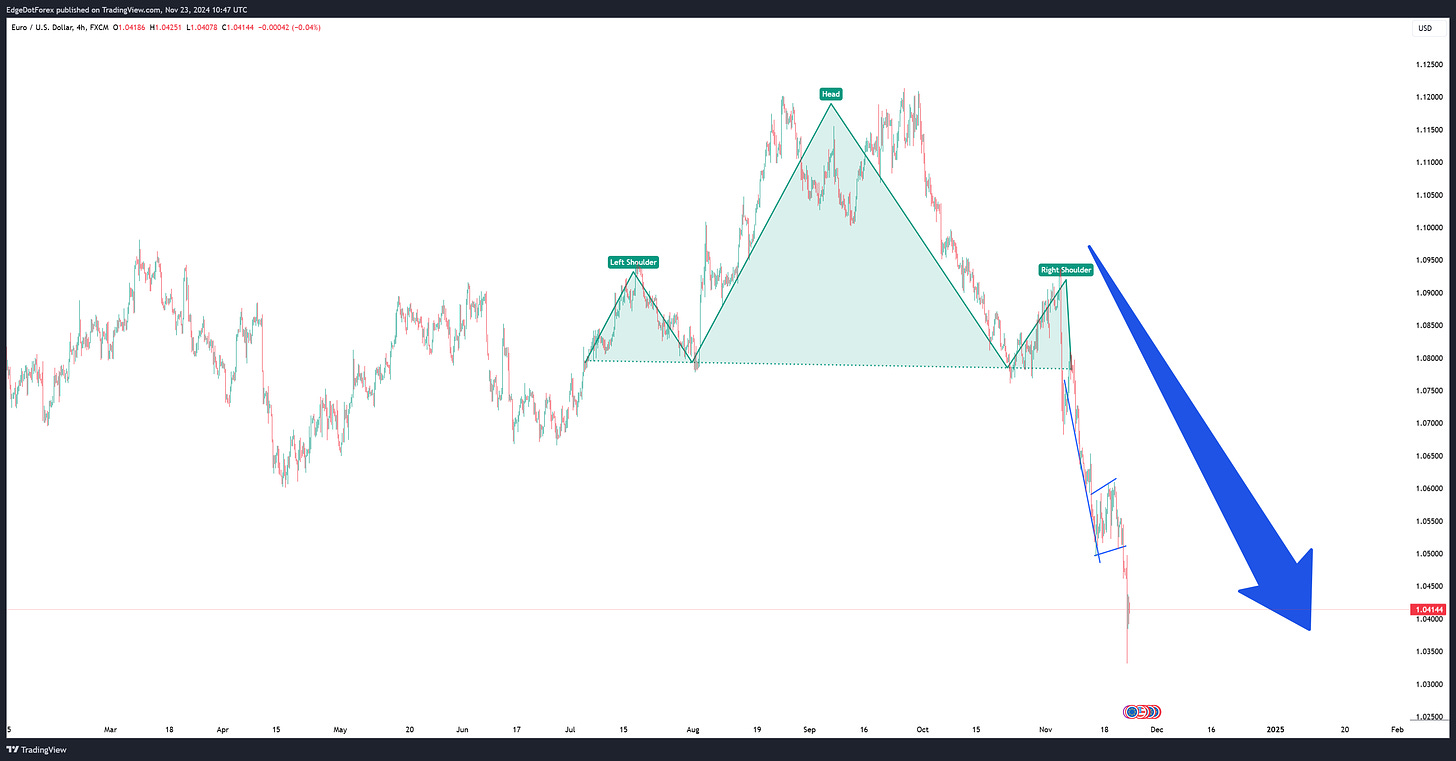

The EUR/USD has been painting masterpieces on the charts lately. I’m talking head and shoulders patterns that even Picasso would appreciate. Look at the left shoulder, head, and right shoulder—all lined up like a well-rehearsed Broadway act. This wasn’t just a chart—it was a bear’s dream come true.

Oh, and let’s not forget the bearish flag patterns that screamed, “SELL ME!” louder than a Black Friday ad. Here’s a quick recap:

📌 The neckline of the head-and-shoulders broke faster than my New Year’s resolutions.

📌 Price collapsed from the 1.11 region, slicing through support zones like butter.

📌 Current price action? Hovering around 1.04, teasing a potential crash to the 2024 lows of 1.03 or even the magical parity zone (1.00).

If you need proof, feast your eyes on these juicy setups:

The Bearish Breakdown: Where It All Went South 🌍📉

Why is EUR/USD playing limbo (“How low can you go?”)? Let me hit you with some truths:

1️⃣ Weak European Data: Europe’s PMI figures are worse than your 6th-grade math test. Manufacturing? Down. Services? Also down. Basically, the Eurozone is channeling its inner Titanic—just without the life rafts. 🛳️💧

2️⃣ Geopolitical Drama: Russia-Ukraine tensions continue to fuel risk aversion. While Europe argues over sanctions, traders flock to the good ol’ US Dollar for safety. 🪖🇺🇸

3️⃣ US Dollar Strength: The USD isn’t just strong—it’s hitting the gym daily. With higher yields and a hawkish Fed, the dollar’s benching currencies like it’s training for a championship. 🏋️💵

Predictions: Crystal Ball Time! 🔮

💡 Short-Term View:

EUR/USD could retest 1.03-1.0350 as the bearish momentum persists. The next key supports sit around the 2024 lows (1.03) and parity (1.00). If we hit 1.00, you can bet the headlines will be screaming “Dollar Dominance.” 📰👑

💡 Rebound Potential?

Don’t hold your breath. Any bounce will likely face resistance at the 1.0600 level, where sellers will be lurking like hawks. Unless the Eurozone suddenly finds an economic miracle, this pair’s future looks grim.

[Insert Image 3: “Potential Path to Parity”]

Strategy: Play It Like a Pro 🎯

Here’s how we’re trading this beast:

1️⃣ Build Short Positions Gradually: No “all-in” moves here. We’re stacking shorts as EUR/USD continues its descent. Remember: consistency beats recklessness every time.

2️⃣ Keep an Eye on Levels: Focus on the 1.04, 1.03, and 1.00 zones. Parity isn’t a question of “if” but “when.”

3️⃣ Stay Transparent: At Edge-Forex, we’re not just talking trades—we’re showing them live. Join the community, watch the trades, and grow with us.

Final Thoughts: The Fall of a Giant 🥀

The EUR/USD isn’t just falling—it’s crashing and burning. With weak Eurozone data, geopolitical risks, and a USD that’s crushing everything in sight, the writing’s on the wall: this pair’s in for a rough ride.

So, what’s your move? Are you riding the bear train to parity, or do you see a surprise bounce coming? Drop your thoughts in the comments below! 👇🔥

🌟 Stay edgy, stay sharp, and let’s crush it together. 🌟

🚀 Edge-Forex: Where markets meet momentum, and YOU profit. 🚀

This post is originally published on ROADTOMILLION.