📰 Headlines, Action, and Sweet, Sweet Predictions:

Ladies and gentlemen, the Dollar Index (DXY) just delivered a performance that deserves a standing ovation. 🎤🎶 If you’ve been trading the markets and somehow missed the action, don’t worry—your friendly Edge-Forex team called it weeks ago. That’s right, while the world scratched its head, we were out here dropping nuggets of wisdom like it was Black Friday for market predictions.

The Setup: A Bullish Symphony in Motion 🎯

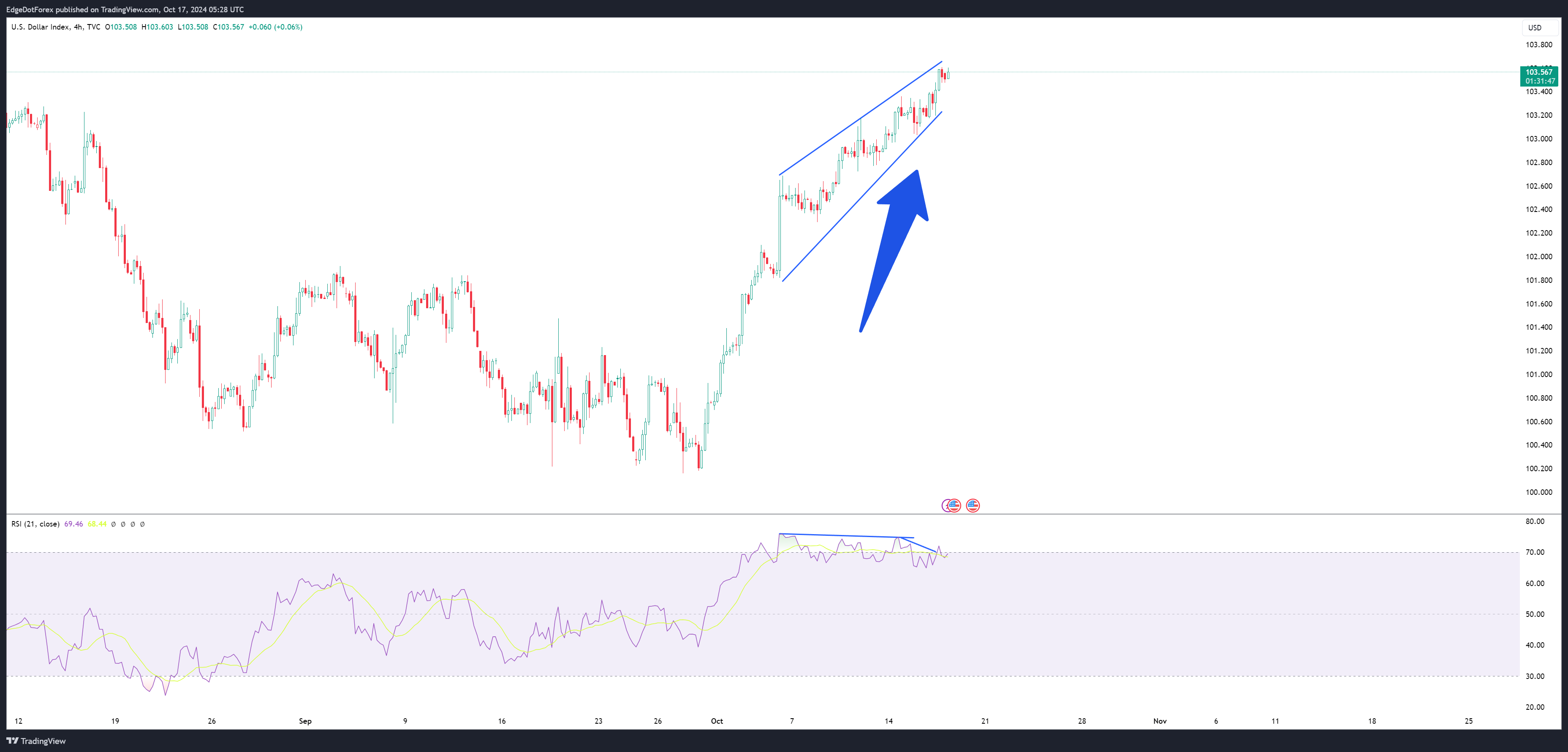

Let’s rewind for a second. Remember This bad boy?

These weren’t just pretty lines on a chart—they were the recipe for one of the cleanest breakouts we’ve seen in months. The DXY was grinding higher inside a bullish channel, showing all the classic signs of strength. Here’s what we saw:

1️⃣ Bullish Momentum: The price was climbing steadily, respecting the channel boundaries like a pro. Think of it as a stairway to heaven—but for the dollar. 💸⤴️

2️⃣ RSI Divergence: Oh, you noticed? The RSI told us the bulls were running out of gas, even as price climbed. But instead of a collapse, we knew this divergence was just a pause—a chance to refuel.

We didn’t just watch it. We didn’t just hope for it. We called it.

From Prediction to Reality: The Bullish Breakout 🚀

Fast forward to today, and what do we have?

Boom 💥—DXY smashed through resistance like a wrecking ball, hitting 107.5 and beyond. This wasn’t a “surprise move.” It was textbook. No, scratch that—it was our textbook.

Here’s how it played out:

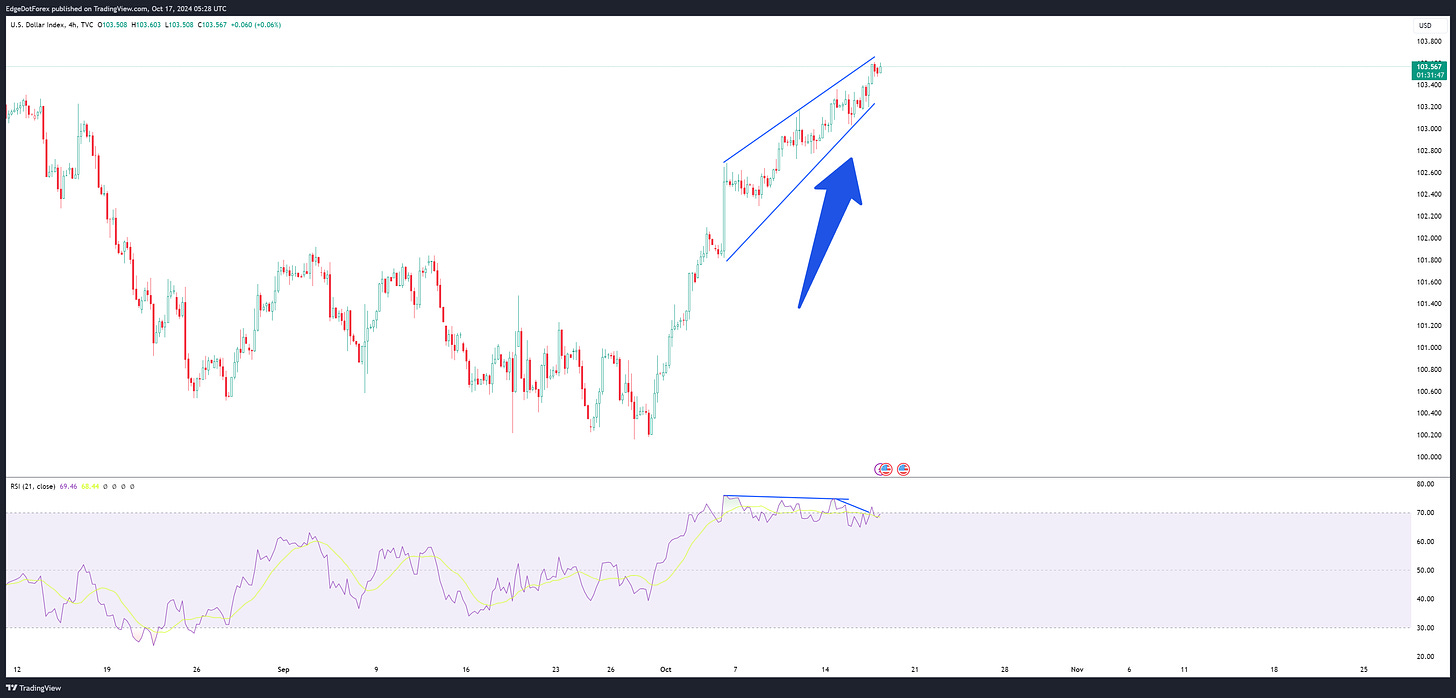

📌 The breakout from 104.5 confirmed bullish dominance. Once the resistance fell, there was no looking back.

📌 A rapid move to 107.5 caught traders off-guard—except, of course, for those following our analysis. 😉

📌 And now? The stage is set for a potential rally to 110-112. Yes, you read that right: triple digits are in the cards.

The “Why”: The Market Loves the Dollar 💵

Why is DXY on fire? Let’s break it down:

1️⃣ Global Chaos = Safe-Haven Dollar: Geopolitical uncertainty (hello, Russia-Ukraine) has everyone running to the USD. When the world panics, the dollar smiles. 😏

2️⃣ Triangle Breakout = Bullish Confidence: Long-term trendlines were shattered, giving way to higher highs.

3️⃣ Strong Fundamentals: The Fed is hawkish, yields are up, and the dollar remains the king of the hill.

Predictions: What’s Next for DXY? 🔮

💡 Short-Term Target:

The DXY is eyeing 110-112 as the next major resistance zone. With momentum on its side, this could happen sooner than you think.

💡 Watch for Pullbacks:

Corrections are normal in a rally like this. Keep an eye on support zones around 105-106.5 for opportunities to reload.

💡 Long-Term Outlook:

If geopolitical risks and economic uncertainty persist, the dollar could stay bullish well into 2025.

Why You Should’ve Seen It Coming (Hint: We Told You) 🧠

Remember these images?

We don’t just analyze the market—we predict its moves with precision. This wasn’t luck, folks. It was methodical, data-driven, and transparent. If you’ve been watching our charts, you’d know this was as clear as day.

Final Thoughts: Ride the Momentum, Stay Ahead 🏆

The DXY rally isn’t just a story of technical precision—it’s a reminder that preparation beats reaction every time. At Edge-Forex, we don’t just wait for the markets to move—we see it coming and act decisively.

So, what’s next for you? Are you riding the dollar train to 110 or sitting on the sidelines? Drop your thoughts below and let’s keep this momentum going. 🔥

🌟 Edge-Forex: Where precision meets profit. Stay sharp, stay ahead. 🌟

This post is originally published on ROADTOMILLION.