ADA’s Wild Ride: Trump’s Crypto Reserve, Tariffs, and Bitcoin Layer-2 Pivot

By Jordan Finneseth Created on March 05, 2025

It’s been a rollercoaster ride for the cryptocurrency market over the past few days, thanks largely to President Donald Trump, whose pro-crypto messaging has had to contend with other policy developments – including the roll out of tariffs on Mexico, Canada, and China.

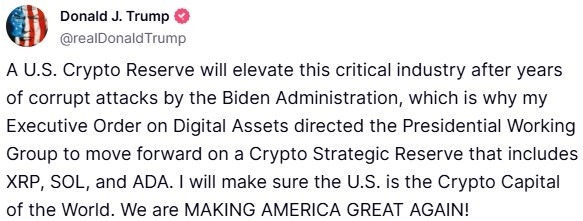

After retesting support at $78,000 on Friday, Bitcoin (BTC) rallied more than 21% over the weekend to hit a high above $95,000 as Trump teased the possibility of establishing strategic reserves for multiple digital assets.

Source: Donald J. Trump

After some in the industry questioned the exclusion of Bitcoin and Ether from the list, Trump followed up by saying, “And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum!”

The comments led to a market-wide rally that saw dozens of tokens record double-digit gains as FOMO initiated a panic to own.

Cardano’s ADA saw one of the largest turnarounds, rallying from a Friday low of $0.58 to hit a high of $1.19 on Sunday, an increase of more than 105%.

ADA/USD 1-day chart. Source: TradingView

But the good times were short-lived. On Monday, Trump reminded the markets that the planned 25% tariffs on products from Mexico and Canada and 20% on products from China would go into effect on Tuesday, leading to a pullback across all financial markets.

The gains for Bitcoin were largely wiped out, with Bitcoin trading back to near $85,000 on Tuesday afternoon after wicking down to $81,500. ADA retreated to a low of $0.75 before dip buyers stepped in to bid it back above $0.91 at the time of writing.

Many in the ecosystem are hopeful that the first-ever White House Crypto Summit scheduled for Friday, March 7 – which will include discussions on regulation and innovation in the cryptocurrency sector – will help spark another revival in the market. But multiple analysts have warned that larger economic developments, including tariffs, will weigh on asset prices until a resolution is reached.

Top Forex Brokers

1 Get Started 74% of retail CFD accounts lose money Read Review

Cardano as a Bitcoin L2

Despite the pump and dump of the past week, the outlook for Cardano remains optimistic.

While Trump’s inclusion of ADA in the list of tokens for a strategic reserve has received some pushback, Cardano holders remain emboldened. Cardano founder Charles Hoskinson said he “thinks the president made the right decision.”

In October, amid the growing demand for institutional access to Bitcoin, Cardano announced a shift in its focus: The network will serve as a layer-2 protocol for Bitcoin.

While the project is not totally abandoning its layer-one roots, it is pivoting development to serve as a Bitcoin L2 by creating “UTXO-enabled interoperability.” Interoperability between siloed blockchain networks remains one of the biggest barriers to mass adoption, and Cardano has opted to pursue the strategic advantage of enabling greater communication with BTC.

By integrating Cardano’s advanced features, the hope is that it will enable Bitcoin to become more versatile and user-friendly. The ultimate goal is for Cardano to work alongside Bitcoin, creating a more seamless user experience while boosting Bitcoin’s capabilities. If successful, Cardano’s place in the ecosystem will be solidified, which could support its price in the long term.

My Take

Developments in the crypto ecosystem are in a constant state of flux, which means nothing is certain. But with Trump directly mentioning ADA in his strategic reserve plans while the network strives to increase Bitcoin usability, there’s a good chance that Cardano will be a long-term survivor as blockchain becomes more mainstream.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox.

Help me Choose a Broker *By registering you agree to receive communications.

Most Visited Forex Broker Reviews

Latest News

This post is originally published on DAILYFOREX.